Interest Rate Swap on:

[Wikipedia]

[Google]

[Amazon]

In finance, an interest rate

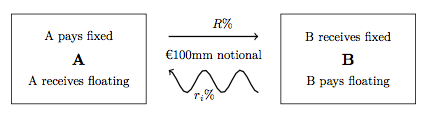

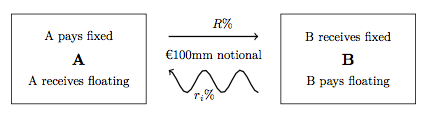

An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index.

The most common IRS is a fixed for floating swap, whereby one party will make payments to the other based on an initially agreed fixed rate of interest, to receive back payments based on a floating interest rate index.

Each of these series of payments is termed a "leg", so a typical IRS has both a fixed and a floating leg.

The floating index is commonly an interbank offered rate (IBOR) of specific tenor in the appropriate currency of the IRS, for example

An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index.

The most common IRS is a fixed for floating swap, whereby one party will make payments to the other based on an initially agreed fixed rate of interest, to receive back payments based on a floating interest rate index.

Each of these series of payments is termed a "leg", so a typical IRS has both a fixed and a floating leg.

The floating index is commonly an interbank offered rate (IBOR) of specific tenor in the appropriate currency of the IRS, for example

J H M Darbyshire, 2017, *the

''Swaps and other derivatives''

(2nd ed.) Wiley. * Miron P. & Swannell P. (1991). ''Pricing and Hedging Swaps'', Euromoney books. Early literature on the incoherence of the one curve pricing approach: * Boenkost W. and Schmidt W. (2004). ''Cross Currency Swap Valuation'', Working Paper 2, HfB - Business School of Finance & Managemen

SSRN preprint.

* Henrard M. (2007). ''The Irony in the Derivatives Discounting'', Wilmott Magazine, pp. 92–98, July 2007

SSRN preprint.

* Henrard M. (2010). ''The Irony in the Derivatives Discounting Part II: The Crisis'', Wilmott Journal, Vol. 2, pp. 301–316, 2010

SSRN preprint.

* Tuckman B. and Porfirio P. (2003). ''Interest Rate Parity, Money Market Basis Swaps and Cross-Currency Basis Swaps'', Fixed income liquid markets research,

SSRN preprint.

* Henrard M. (2014) ''Interest Rate Modelling in the Multi-curve Framework: Foundations, Evolution, and Implementation.'' Palgrave Macmillan. Applied Quantitative Finance series. June 2014. . * Kijima M., Tanaka K., and Wong T. (2009). ''A Multi-Quality Model of Interest Rates'', Quantitative Finance, pages 133-145, 2009.

Pricing and Trading Interest Rate Derivatives

by J H M Darbyshire

Understanding Derivatives: Markets and Infrastructure

Federal Reserve Bank of Chicago, Financial Markets Group

- Semiannual OTC derivatives statistics

- Interest rate swap glossary

Investopedia - Spreadlock

- An interest rate swap future (not an option)

Basic Fixed Income Derivative Hedging

- Article on Financial-edu.com.

Historical LIBOR Swaps data

''WorldwideInterestRates.com''

Interest Rate Swap Calculators and Portfolio Management ToolG4 LIBOR Swap Calculator

{{Derivatives market Derivatives (finance)

swap

Swap or SWAP may refer to:

Finance

* Swap (finance), a derivative in which two parties agree to exchange one stream of cash flows against another

* Barter

Science and technology

* Swap (computer programming), exchanging two variables in t ...

(IRS) is an interest rate derivative (IRD). It involves exchange of interest rates between two parties. In particular it is a "linear" IRD and one of the most liquid, benchmark products. It has associations with forward rate agreements (FRAs), and with zero coupon swaps (ZCSs).

In its December 2014 statistics release, the Bank for International Settlements

The Bank for International Settlements (BIS) is an international financial institution owned by central banks that "fosters international monetary and financial cooperation and serves as a bank for central banks".

The BIS carries out its work thr ...

reported that interest rate swaps were the largest component of the global OTC derivative

In mathematics, the derivative of a function of a real variable measures the sensitivity to change of the function value (output value) with respect to a change in its argument (input value). Derivatives are a fundamental tool of calculus. ...

market, representing 60%, with the notional amount outstanding in OTC interest rate swaps of $381 trillion, and the gross market value of $14 trillion.

Interest rate swaps can be traded as an index through the FTSE MTIRS Index

The FTSE MTIRS Indices are designed to accurately move in direct correlation to OTC Interest Rate Swaps market with a total of 45 indices covering the USD curve from 2 years to 30 years including spreads and butterflies. FTSE MTIRS Indices accoun ...

.

Interest rate swaps

General description

An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index.

The most common IRS is a fixed for floating swap, whereby one party will make payments to the other based on an initially agreed fixed rate of interest, to receive back payments based on a floating interest rate index.

Each of these series of payments is termed a "leg", so a typical IRS has both a fixed and a floating leg.

The floating index is commonly an interbank offered rate (IBOR) of specific tenor in the appropriate currency of the IRS, for example

An interest rate swap's (IRS's) effective description is a derivative contract, agreed between two counterparties, which specifies the nature of an exchange of payments benchmarked against an interest rate index.

The most common IRS is a fixed for floating swap, whereby one party will make payments to the other based on an initially agreed fixed rate of interest, to receive back payments based on a floating interest rate index.

Each of these series of payments is termed a "leg", so a typical IRS has both a fixed and a floating leg.

The floating index is commonly an interbank offered rate (IBOR) of specific tenor in the appropriate currency of the IRS, for example LIBOR

The London Inter-Bank Offered Rate is an interest-rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. The resulting average rate is u ...

in GBP, EURIBOR

The Euro Interbank Offered Rate (Euribor) is a daily reference rate, published by the European Money Markets Institute, based on the averaged interest rates at which Eurozone banks offer to lend unsecured funds to other banks in the euro whole ...

in EUR, or STIBOR in SEK.

To completely determine any IRS a number of parameters must be specified for each leg: Pricing and Trading Interest Rate Derivatives: A Practical Guide to SwapsJ H M Darbyshire, 2017, *the

notional principal amount

The notional amount (or notional principal amount or notional value) on a financial instrument is the nominal or face amount that is used to calculate payments made on that instrument. This amount generally does not change and is thus referred to a ...

(or varying notional schedule);

*the start and end dates, value-, trade- and settlement date Settlement date is a securities industry term describing the date on which a trade (bonds, equities, foreign exchange, commodities, etc.) settles. That is, the actual day on which transfer of cash or assets is completed and is usually a few days a ...

s, and date scheduling (date rolling

Date or dates may refer to:

*Date (fruit), the fruit of the date palm (''Phoenix dactylifera'')

Social activity

*Dating, a form of courtship involving social activity, with the aim of assessing a potential partner

**Group dating

* Play date, a ...

);

*the fixed rate (i.e. " swap rate", sometimes quoted as a " swap spread" over a benchmark);

*the chosen floating interest rate index tenor

A tenor is a type of classical male singing voice whose vocal range lies between the countertenor and baritone voice types. It is the highest male chest voice type. The tenor's vocal range extends up to C5. The low extreme for tenors is wide ...

;

*the day count convention In finance, a day count convention determines how interest accrues over time for a variety of investments, including bonds, notes, loans, mortgages, medium-term notes, swaps, and forward rate agreements (FRAs). This determines the number of days ...

s for interest calculations.

Each currency has its own standard market conventions regarding the frequency of payments, the day count conventions and the end-of-month rule.

Extended description

As OTC instruments, interest rate swaps (IRSs) can be customised in a number of ways and can be structured to meet the specific needs of the counterparties. For example: payment dates could be irregular, the notional of the swap could beamortized

In computer science, amortized analysis is a method for analyzing a given algorithm's complexity, or how much of a resource, especially time or memory, it takes to execute. The motivation for amortized analysis is that looking at the worst-case ...

over time, reset dates (or fixing dates) of the floating rate could be irregular, mandatory break clauses may be inserted into the contract, etc.

A common form of customisation is often present in new issue swaps where the fixed leg cashflows are designed to replicate those cashflows received as the coupons on a purchased bond.

The interbank market

The interbank market is the top-level foreign exchange market where banks exchange different currencies. The banks can either deal with one another directly, or through electronic brokering platforms. The Electronic Broking Services (EBS) and Thom ...

, however, only has a few standardised types.

There is no consensus on the scope of naming convention for different types of IRS.

Even a wide description of IRS contracts only includes those whose legs are denominated in the same currency.

It is generally accepted that swaps of similar nature whose legs are denominated in different currencies are called cross currency basis swaps.

Swaps which are determined on a floating rate index in one currency but whose payments are denominated in another currency are called Quanto A quanto is a type of derivative in which the underlying is denominated in one currency,

but the instrument itself is settled in another currency at some rate. Such products are attractive for speculators and investors who wish to have exposure to a ...

s.

In traditional interest rate derivative terminology an IRS is a fixed leg versus floating leg derivative contract referencing an IBOR as the floating leg.

If the floating leg is redefined to be an overnight index, such as EONIA, SONIA, FFOIS, etc. then this type of swap is generally referred to as an overnight indexed swap (OIS).

Some financial literature may classify OISs as a subset of IRSs and other literature may recognise a distinct separation.

Fixed leg versus fixed leg swaps are rare, and generally constitute a form of specialised loan agreement.

Float leg versus float leg swaps are much more common. These are typically termed (single currency) basis swap A basis swap is an interest rate swap which involves the exchange of two floating rate financial instruments. A basis swap functions as a floating-floating interest rate swap under which the floating rate payments are referenced to different bases. ...

s (SBSs). The legs on SBSs will necessarily be different interest indexes, such as 1M, LIBOR, 3M LIBOR, 6M LIBOR, SONIA, etc. The pricing of these swaps requires a spread often quoted in basis points to be added to one of the floating legs in order to satisfy value equivalence.

Uses

Interest rate swaps are used to hedge against or speculate on changes in interest rates. Interest rate swaps are also used speculatively by hedge funds or other investors who expect a change in interest rates or the relationships between them. Traditionally, fixed income investors who expected rates to fall would purchase cash bonds, whose value increased as rates fell. Today, investors with a similar view could enter a floating-for-fixed interest rate swap; as rates fall, investors would pay a lower floating rate in exchange for the same fixed rate. Interest rate swaps are also popular for the arbitrage opportunities they provide. Varying levels ofcreditworthiness

A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased ...

means that there is often a positive quality spread differential that allows both parties to benefit from an interest rate swap.

The interest rate swap market in USD is closely linked to the Eurodollar

Eurodollars are U.S. dollars held in time deposit accounts in banks outside the United States, which thus are not subject to the legal jurisdiction of the U.S. Federal Reserve. Consequently, such deposits are subject to much less regulation than ...

futures market which trades among others at the Chicago Mercantile Exchange.

Valuation and pricing

IRSs are bespoke financial products whose customisation can include changes to payment dates, notional changes (such as those in amortised IRSs), accrual period adjustment and calculation convention changes (such as aday count convention In finance, a day count convention determines how interest accrues over time for a variety of investments, including bonds, notes, loans, mortgages, medium-term notes, swaps, and forward rate agreements (FRAs). This determines the number of days ...

of 30/360E to ACT/360 or ACT/365).

A vanilla IRS is the term used for standardised IRSs. Typically these will have none of the above customisations, and instead exhibit constant notional throughout, implied payment and accrual dates and benchmark calculation conventions by currency. A vanilla IRS is also characterised by one leg being "fixed" and the second leg "floating" referencing an -IBOR index. The net present value

In economics and finance, present value (PV), also known as present discounted value, is the value of an expected income stream determined as of the date of valuation. The present value is usually less than the future value because money has inte ...

(PV) of a vanilla IRS can be computed by determining the PV of each fixed leg and floating leg separately and summing. For pricing a mid-market IRS the underlying principle is that the two legs must have the same value initially; see further under Rational pricing.

Calculating the fixed leg requires discounting all of the known cashflows by an appropriate discount factor:

:

where is the notional, is the fixed rate, is the number of payments, is the decimalised day count fraction of the accrual in the i'th period, and is the discount factor associated with the payment date of the i'th period.

Calculating the floating leg is a similar process replacing the fixed rate with forecast index rates:

:

where is the number of payments of the floating leg and are the forecast -IBOR index rates of the appropriate currency.

The PV of the IRS from the perspective of receiving the fixed leg is then:

:

Historically IRSs were valued using discount factors derived from the same curve used to forecast the -IBOR rates. This has been called 'self-discounted'. Some early literature described some incoherence introduced by that approach and multiple banks were using different techniques to reduce them. It became more apparent with the 2007–2012 global financial crisis

7 (seven) is the natural number following 6 and preceding 8. It is the only prime number preceding a cube.

As an early prime number in the series of positive integers, the number seven has greatly symbolic associations in religion, mythology, ...

that the approach was not appropriate, and alignment towards discount factors associated with physical collateral

Collateral may refer to:

Business and finance

* Collateral (finance), a borrower's pledge of specific property to a lender, to secure repayment of a loan

* Marketing collateral, in marketing and sales

Arts, entertainment, and media

* ''Collate ...

of the IRSs was needed.

Post crisis, to accommodate credit risk, the now-standard pricing approach is the multi-curve framework where forecast -IBOR rates and discount factors exhibit disparity.

Note that the economic pricing principle is unchanged: leg values are still identical at initiation. See Financial economics § Derivative pricing for further context.

Here, overnight index swap (OIS) rates are typically used to derive discount factors, since that index is the standard inclusion on Credit Support Annex A Credit Support Annex, or CSA, is a legal document which regulates credit support (collateral) for derivative transactions. It is one of the four parts that make up an ISDA Master Agreement but is not mandatory. It is possible to have an ISDA agre ...

es (CSAs) to determine the rate of interest payable on collateral for IRS contracts. As regards the rates forecast, since the basis spread between LIBOR

The London Inter-Bank Offered Rate is an interest-rate average calculated from estimates submitted by the leading banks in London. Each bank estimates what it would be charged were it to borrow from other banks. The resulting average rate is u ...

rates of different maturities widened during the crisis, forecast curves are generally constructed for each LIBOR tenor used in floating rate derivative legs.

Regarding the curve build, see:

Under the old framework a single self discounted curve was "bootstrapped" for each tenor;

i.e.: solved such that it exactly returned the observed prices of selected instruments—IRSs, with FRAs FRAS may refer to:

* Fellow of the Royal Astronomical Society

(Whatever shines should be observed)

, predecessor =

, successor =

, formation =

, founder =

, extinction =

, merger ...

in the short end—with the build proceeding sequentially, date-wise, through these instruments.

Under the new framework, the various curves are best fit

Curve fitting is the process of constructing a curve, or mathematical function, that has the best fit to a series of data points, possibly subject to constraints. Curve fitting can involve either interpolation, where an exact fit to the data is ...

ted to observed market prices—as a "curve set"—one curve for discounting, one for each IBOR-tenor "forecast curve",

and the build is then based on quotes for IRSs ''and'' OISs, with FRAs included as before.

Here, since the observed average overnight rate

The overnight rate is generally the interest rate that large banks use to borrow and lend from one another in the overnight market. In some countries (the United States, for example), the overnight rate may be the rate targeted by the central ban ...

is swapped for the -IBOR rate over the same period (the most liquid tenor in that market), and the -IBOR IRSs are in turn discounted on the OIS curve, the problem entails a nonlinear system, where all curve points are solved at once, and specialized iterative methods

In computational mathematics, an iterative method is a mathematical procedure that uses an initial value to generate a sequence of improving approximate solutions for a class of problems, in which the ''n''-th approximation is derived from the pre ...

are usually employed—very often a modification of Newton's method.

The forecast-curves for other tenors can be solved in a "second stage", bootstrap-style, with discounting on the now-solved OIS curve.

Under both frameworks, the following apply.

(i) Maturities for which rates are solved directly are referred to as "pillar points", these correspond to the input instrument maturities; other rates are interpolated

In the mathematical field of numerical analysis, interpolation is a type of estimation, a method of constructing (finding) new data points based on the range of a discrete set of known data points.

In engineering and science, one often has a n ...

, often using Hermitic splines.

(ii) The objective function

In mathematical optimization and decision theory, a loss function or cost function (sometimes also called an error function) is a function that maps an event or values of one or more variables onto a real number intuitively representing some "cost ...

: prices must be "exactly" returned, as described.

(iii) The penalty function Penalty methods are a certain class of algorithms for solving constrained optimization problems.

A penalty method replaces a constrained optimization problem by a series of unconstrained problems whose solutions ideally converge to the solution of ...

will weigh: that forward rates are positive (to be arbitrage free) and curve "smoothness"; both, in turn, a function of the interpolation method.

(iv) The initial estimate: usually, the most recently solved curve set.

((v) All that need be stored are the solved spot rate

In finance, a spot contract, spot transaction, or simply spot, is a contract of buying or selling a commodity, security or currency for immediate settlement (payment and delivery) on the spot date, which is normally two business days after ...

s for the pillars, and the interpolation rule.)

A CSA could allow for collateral, and hence interest payments on that collateral, in any currency.

To accommodate this, banks include in their curve-set a USD discount-curve to be used for discounting local-IBOR trades which have USD collateral; this curve is sometimes called the "basis-curve".

It is built by solving for observed (mark-to-market) cross-currency swap rates, where the local -IBOR is swapped for USD LIBOR with USD collateral as underpin.

The latest, pre-solved USD-LIBOR-curve is therefore an (external) element of the curve-set, and the basis-curve is then solved in the "third stage".

Each currency's curve-set will thus include a local-currency discount-curve and its USD discounting basis-curve.

As required, a third-currency discount curve — i.e. for local trades collateralized in a currency other than local or USD (or any other combination) — can then be constructed from the local-currency basis-curve and third-currency basis-curve, combined via an arbitrage relationship known here as "FX Forward Invariance".

LIBOR is due to be phased out by the end of 2021, with replacements including SOFR

Secured Overnight Financing Rate (SOFR) is a secured interbank overnight interest rate. SOFR is a reference rate (that is, a rate used by parties in commercial contracts that is outside their direct control) established as an alternative to LIBOR. ...

and TONAR Tokyo Overnight Average Rate (TONA rate or TONAR) or Japanese Yen Uncollateralized Overnight Call Rate ( ja, 無担保コールO/N物レート) is an unsecured interbank overnight interest rate and reference rate for Japanese yen. Mutan rate and TO ...

.

With the coexistence of "old" and "new" rates in the market, multi-curve and OIS curve "management" is necessary, with changes required to incorporate new discounting and compounding conventions, while the underlying logic is unaffected; see.

The complexities of modern curvesets mean that there may not be discount factors available for a specific -IBOR index curve. These curves are known as 'forecast only' curves and only contain the information of a forecast -IBOR index rate for any future date. Some designs constructed with a discount based methodology mean forecast -IBOR index rates are implied by the discount factors inherent to that curve:

: where and are the start and end ''discount factors'' associated with the relevant forward curve of a particular -IBOR index in a given currency.

To price the mid-market or par rate, of an IRS (defined by the value of fixed rate that gives a net PV of zero), the above formula is re-arranged to:

:

In the event old methodologies are applied the discount factors can be replaced with the self discounted values and the above reduces to:

:

In both cases, the PV of a general swap can be expressed exactly with the following intuitive formula:

:

where is the so-called Annuity

In investment, an annuity is a series of payments made at equal intervals.Kellison, Stephen G. (1970). ''The Theory of Interest''. Homewood, Illinois: Richard D. Irwin, Inc. p. 45 Examples of annuities are regular deposits to a savings account, ...

factor (or for self-discounting). This shows that the PV of an IRS is roughly linear in the swap par rate (though small non-linearities arise from the co-dependency of the swap rate with the discount factors in the Annuity sum).

During the life of the swap the same valuation technique is used, but since, over time, both the discounting factors and the forward rates change, the PV of the swap will deviate from its initial value. Therefore, the swap will be an asset to one party and a liability to the other.

The way these changes in value are reported is the subject of IAS 39

IAS 39: Financial Instruments: Recognition and Measurement was an international accounting standard which outlined the requirements for the recognition and measurement of financial assets, financial liabilities, and some contracts to buy or sell n ...

for jurisdictions following IFRS

International Financial Reporting Standards, commonly called IFRS, are accounting standards issued by the IFRS Foundation and the International Accounting Standards Board (IASB). They constitute a standardised way of describing the company's fina ...

, and FAS 133

Launched prior to the millennium, (and subsequently amended) FAS 133 ''Accounting for Derivative Instruments and Hedging Activities'' provided an "integrated accounting framework for derivative instruments and hedging activities."

FAS 133 Overvi ...

for U.S. GAAP

Generally Accepted Accounting Principles (GAAP or U.S. GAAP, pronounced like "gap") is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC) and is the default accounting standard used by companies based in the Uni ...

.

Swaps are marked to market by debt security traders to visualize their inventory at a certain time.

As regards P&L Attribution, and hedging, the new framework adds complexity in that the trader's position is now potentially affected by numerous instruments not obviously related to the trade in question.

Risks

Interest rate swaps expose users to many different types of financial risk. Predominantly they expose the user tomarket risk

Market risk is the risk of losses in positions arising from movements in market variables like prices and volatility.

There is no unique classification as each classification may refer to different aspects of market risk. Nevertheless, the most ...

s and specifically interest rate risk.

The value of an interest rate swap will change as market interest rates rise and fall. In market terminology this is often referred to as delta risk.

Interest rate swaps also exhibit gamma risk whereby their delta risk increases or decreases as market interest rates fluctuate.

(See Greeks (finance), Value at risk #Computation methods, Value at risk #VaR risk management.)

Other specific types of market risk that interest rate swaps have exposure to are basis risk

Basis risk in finance is the risk associated with imperfect hedging due to the variables or characteristics that affect the difference between the futures contract and the underlying "cash" position. It arises because of the difference between th ...

s—where various IBOR tenor indexes can deviate from one another—and reset risks - where the publication of specific tenor IBOR indexes are subject to daily fluctuation.

Uncollateralised interest rate swaps—those executed bilaterally without a CSA in place—expose the trading counterparties to funding risks and credit risk

A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased ...

s.

Funding risks because the value of the swap might deviate to become so negative that it is unaffordable and cannot be funded.

Credit risks because the respective counterparty, for whom the value of the swap is positive, will be concerned about the opposing counterparty defaulting on its obligations. Collateralised interest rate swaps, on the other hand, expose the users to collateral risks: here, depending upon the terms of the CSA, the type of posted collateral that is permitted might become more or less expensive due to other extraneous market movements.

Credit and funding risks still exist for collateralised trades but to a much lesser extent.

Regardless, due to regulations set out in the Basel III

Basel III is the third Basel Accord, a framework that sets international standards for bank capital adequacy, stress testing, and liquidity requirements. Augmenting and superseding parts of the Basel II standards, it was developed in response t ...

Regulatory Frameworks, trading interest rate derivatives commands a capital usage. The consequence of this is that, dependent upon their specific nature, interest rate swaps might command more capital usage, and this can deviate with market movements. Thus capital risks are another concern for users.

Given these concerns, banks will typically calculate a credit valuation adjustment Credit valuation adjustments (CVAs) are accounting adjustments made to reserve a portion of profits on uncollateralized financial derivatives. They are charged by a bank to a risky (capable of default) counterparty to compensate the bank for taking ...

, as well as other x-valuation adjustments, which then incorporate these risks into the instrument value.

Reputation risks also exist. The mis-selling of swaps, over-exposure of municipalities to derivative contracts, and IBOR manipulation are examples of high-profile cases where trading interest rate swaps has led to a loss of reputation and fines by regulators.

Hedging interest rate swaps can be complicated and relies on numerical processes of well designed risk models to suggest reliable benchmark trades that mitigate all market risks; although, see the discussion above re hedging in a multi-curve environment. The other, aforementioned risks must be hedged using other systematic processes.

Quotation and market-making

ICE Swap rate

ICE Swap rate replaced the rate formerly known as ISDAFIX in 2015. Swap Rate benchmark rates are calculated using eligible prices and volumes for specified interest rate derivative products. The prices are provided by trading venues in accordance with a “Waterfall” Methodology. The first level of the Waterfall (“Level 1”) uses eligible, executable prices and volumes provided by regulated, electronic, trading venues. Multiple, randomised snapshots of market data are taken during a short window before calculation. This enhances the benchmark's robustness and reliability by protecting against attempted manipulation and temporary aberrations in the underlying market.Market-making

The market-making of IRSs is an involved process involving multiple tasks; curve construction with reference to interbank markets, individual derivative contract pricing, risk management of credit, cash and capital. The cross disciplines required include quantitative analysis and mathematical expertise, disciplined and organized approach towards profits and losses, and coherent psychological and subjective assessment of financial market information and price-taker analysis. The time sensitive nature of markets also creates a pressurized environment. Many tools and techniques have been designed to improve efficiency of market-making in a drive to efficiency and consistency.Controversy

In June 1988 the Audit Commission was tipped off by someone working on the swaps desk of Goldman Sachs that theLondon Borough of Hammersmith and Fulham

The London Borough of Hammersmith and Fulham () is a London borough in West London and which also forms part of Inner London. The borough was formed in 1965 from the merger of the former Metropolitan Boroughs of Hammersmith and Fulham. The borou ...

had a massive exposure to interest rate swaps. When the commission contacted the council, the chief executive told them not to worry as "everybody knows that interest rates are going to fall"; the treasurer thought the interest rate swaps were a "nice little earner". The Commission's Controller, Howard Davies, realised that the council had put all of its positions on interest rates going down and ordered an investigation.Duncan Campbell-Smith, "Follow the Money: The Audit Commission, Public Money, and the Management of Public Services 1983-2008", Allen Lane, 2008, chapter 6 ''passim''.

By January 1989 the Commission obtained legal opinions from two Queen's Counsel

In the United Kingdom and in some Commonwealth countries, a King's Counsel (post-nominal initials KC) during the reign of a king, or Queen's Counsel (post-nominal initials QC) during the reign of a queen, is a lawyer (usually a barrister o ...

. Although they did not agree, the commission preferred the opinion that it was ''ultra vires

('beyond the powers') is a Latin phrase used in law to describe an act which requires legal authority but is done without it. Its opposite, an act done under proper authority, is ('within the powers'). Acts that are may equivalently be termed ...

'' for councils to engage in interest rate swaps (ie. that they had no lawful power to do so). Moreover, interest rates had increased from 8% to 15%. The auditor and the commission then went to court and had the contracts declared void (appeals all the way up to the House of Lords

The House of Lords, also known as the House of Peers, is the Bicameralism, upper house of the Parliament of the United Kingdom. Membership is by Life peer, appointment, Hereditary peer, heredity or Lords Spiritual, official function. Like the ...

failed in ''Hazell v Hammersmith and Fulham LBC O

''Hazell v Hammersmith and Fulham LBC'' 9922 AC 1 is an English administrative law case, which declared that local authorities had no power to engage in interest rate swap agreements because they were beyond the council's borrowing powers, and ...

''); the five banks involved lost millions of pounds. Many other local authorities had been engaging in interest rate swaps in the 1980s.Duncan Campbell-Smith, "Follow the Money: The Audit Commission, Public Money, and the Management of Public Services 1983-2008", Allen Lane, 2008, chapter 6 ''passim''. This resulted in several cases in which the banks generally lost their claims for compound interest on debts to councils, finalised in '' Westdeutsche Landesbank Girozentrale v Islington London Borough Council''. Banks did, however, recover some funds where the derivatives were "in the money" for the Councils (ie, an asset showing a profit for the council, which it now had to return to the bank, not a debt).Duncan Campbell-Smith, "Follow the Money: The Audit Commission, Public Money, and the Management of Public Services 1983-2008", Allen Lane, 2008, chapter 6 ''passim''.

The controversy surrounding interest rate swaps reached a peak in the UK during the financial crisis where banks sold unsuitable interest rate hedging products on a large scale to SMEs. The practice has been widely criticised by the media and Parliament.

See also

* Constant maturity swap *Equity swap

An equity swap is a financial derivative contract (a swap) where a set of future cash flows are agreed to be exchanged between two counterparties at set dates in the future. The two cash flows are usually referred to as "legs" of the swap; one of ...

* Eurodollar

Eurodollars are U.S. dollars held in time deposit accounts in banks outside the United States, which thus are not subject to the legal jurisdiction of the U.S. Federal Reserve. Consequently, such deposits are subject to much less regulation than ...

* FTSE MTIRS Index

The FTSE MTIRS Indices are designed to accurately move in direct correlation to OTC Interest Rate Swaps market with a total of 45 indices covering the USD curve from 2 years to 30 years including spreads and butterflies. FTSE MTIRS Indices accoun ...

* Inflation derivative

In finance, inflation derivative (or inflation-indexed derivatives) refers to an over-the-counter and exchange-traded derivative that is used to transfer inflation risk from one counterparty to another. See Exotic derivatives.

Derivative

Typical ...

* Interest rate cap and floor An interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price. An example of a cap would be an agreement to receive a payment for ...

* Swap rate

* Total return swap

Total return swap, or TRS (especially in Europe), or total rate of return swap, or TRORS, or Cash Settled Equity Swap is a financial contract that transfers both the credit risk and market risk of an underlying asset.

Contract definition

A sw ...

References

Further reading

General: * * * Richard Flavell (2010)''Swaps and other derivatives''

(2nd ed.) Wiley. * Miron P. & Swannell P. (1991). ''Pricing and Hedging Swaps'', Euromoney books. Early literature on the incoherence of the one curve pricing approach: * Boenkost W. and Schmidt W. (2004). ''Cross Currency Swap Valuation'', Working Paper 2, HfB - Business School of Finance & Managemen

SSRN preprint.

* Henrard M. (2007). ''The Irony in the Derivatives Discounting'', Wilmott Magazine, pp. 92–98, July 2007

SSRN preprint.

* Henrard M. (2010). ''The Irony in the Derivatives Discounting Part II: The Crisis'', Wilmott Journal, Vol. 2, pp. 301–316, 2010

SSRN preprint.

* Tuckman B. and Porfirio P. (2003). ''Interest Rate Parity, Money Market Basis Swaps and Cross-Currency Basis Swaps'', Fixed income liquid markets research,

Lehman Brothers

Lehman Brothers Holdings Inc. ( ) was an American global financial services firm founded in 1847. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, a ...

Multi-curves framework:

* Bianchetti M. (2010). ''Two Curves, One Price: Pricing & Hedging Interest Rate Derivatives Decoupling Forwarding and Discounting Yield Curves'', Risk Magazine, August 2010SSRN preprint.

* Henrard M. (2014) ''Interest Rate Modelling in the Multi-curve Framework: Foundations, Evolution, and Implementation.'' Palgrave Macmillan. Applied Quantitative Finance series. June 2014. . * Kijima M., Tanaka K., and Wong T. (2009). ''A Multi-Quality Model of Interest Rates'', Quantitative Finance, pages 133-145, 2009.

External links

Pricing and Trading Interest Rate Derivatives

by J H M Darbyshire

Understanding Derivatives: Markets and Infrastructure

Federal Reserve Bank of Chicago, Financial Markets Group

- Semiannual OTC derivatives statistics

- Interest rate swap glossary

Investopedia - Spreadlock

- An interest rate swap future (not an option)

Basic Fixed Income Derivative Hedging

- Article on Financial-edu.com.

''WorldwideInterestRates.com''

Interest Rate Swap Calculators and Portfolio Management Tool

{{Derivatives market Derivatives (finance)

Swap

Swap or SWAP may refer to:

Finance

* Swap (finance), a derivative in which two parties agree to exchange one stream of cash flows against another

* Barter

Science and technology

* Swap (computer programming), exchanging two variables in t ...

Swaps (finance)